9 min read

7 Best Compound Interest Investments (Overview + Examples)

Oct 20, 2023 9:00:00 AM

7 Best Compound Interest Investments (Overview + Examples)

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” — Albert Einstein

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” — Warren Buffet

“If you understand compound interest, you basically understand the universe.” — Robert Breault

Many great thinkers have contemplated the power of compound interest – it’s fascinating stuff! And if you’re reading this article, you’re probably interested in learning more about it yourself ...

- What is compound interest?

- How does compound interest work?

Can you benefit from compound interest as part of your financial plan?

These are exciting questions to consider! I would guess that you’re in pretty good financial shape – with manageable levels of debt, good saving and spending habits, and some form of retirement plan in place. You may have some cash set aside that hasn’t been earning much (if any) interest, and you’re researching your options.

If any of this sounds like you, you’ve come to the right place!

🔑 Free resource: Financial planning template for individuals and families

With the current interest rate environment, there are more good compound interest investment options available than we’ve seen in years. In this article, we'll discuss a number of different ones, from more conservative money market accounts and CDs to riskier stock funds and REITs, as well as several options in between.

Whatever your investment experience and risk tolerance may be, I’m confident that at least one of the following compound interest investments is right for you!

What is compound interest? (a definition)

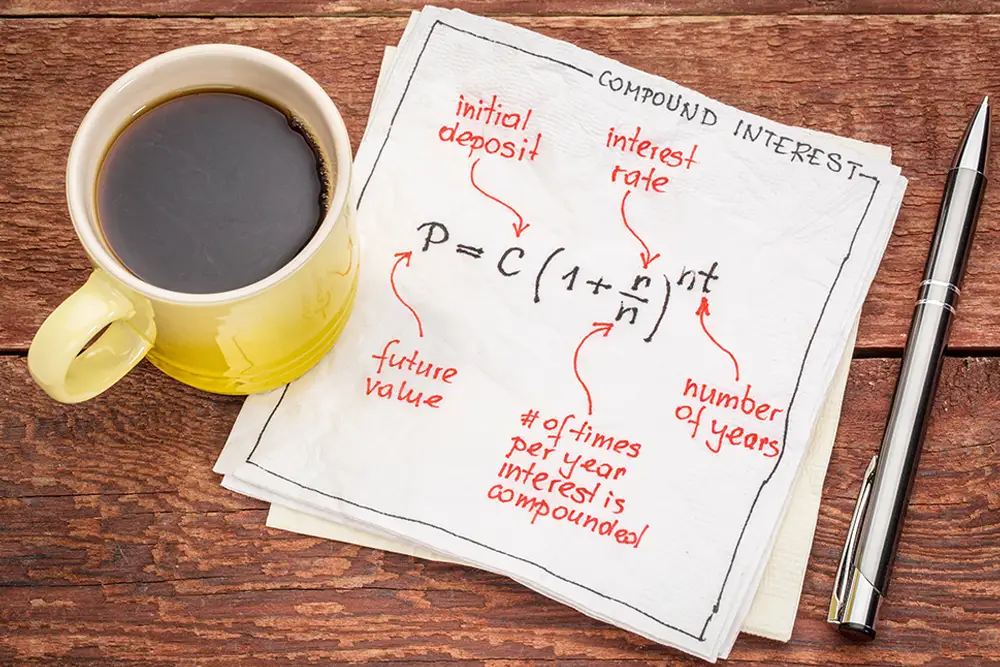

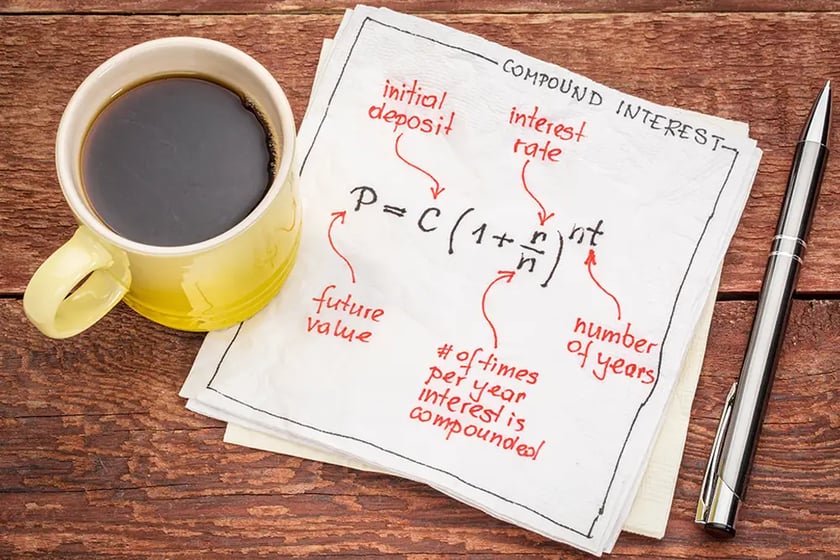

The term “compound interest” refers to any investment that increases in value over time and whose future earnings are based on both the principal and the accumulated interest earned during the prior investment period(s).

🔎 Related: How to invest for retirement at age 40 (+ examples)

That sounds kind of confusing, but let's walk through it together:

- Your principal is the initial amount of money you invested.

- Your accumulated interest is the money you earned on that investment.

- Compounding occurs when the earnings are added back to the initial investment and a new investment period begins – in which you are making money on both the original investment, as well as the interest earned.

Compound interest investment example

Say you have $10,000 and you want to invest in a 5-year CD earning 5% annual interest. The first year, your $10,000 earns you $500. During the second year, however, you’re not just earning 5% on that same $10,000 – you’re now earning 5% on $10,500 ($10,000 + $500) and your investment grows to $11,025.

During the following year, your investment grows to $11,576.25. By the end of year five, your investment has grown to $12,762.81 – compared to the $12,500 you would have if the investment did not compound.

🔎 Related: How much does investment management cost? (+ examples)

You may be thinking,:

“Big deal, compound interest earned me an additional $262.81 over FIVE YEARS. What’s that – 4 tanks of gas?”

Don't get me wrong, I hear you. The real secret to the power of compound interest, however, is time.

What if your initial $10,000 had 40 years to grow at 5% compounded annually? You would have about $70,400 vs. just $30,000 with simple interest. In this example, compound interest alone more than doubles your return – no additional thought or effort required!

Once put into motion, compound interest investing can be a great way to build wealth, especially over long periods of time.

The Rule of 72 and compound interest

The Rule of 72 is a simple formula that estimates how long it will take for your money to double. This rule applies specifically to compound interest investments, and it works best when interest rates are between 6% & 10%.

Simply divide the number 72 by the interest rate on your investment. Your solution is the number of years it will take to double your initial investment.

🔎 Related: Is the stock market gambling?

The Rule of 72 compound interest example

Imagine you have a lump sum to invest and you found a way to earn a 6% annual return — 72/6 = 12. Meaning, in 12 years, you will have twice as much money. If you were lucky enough to secure a 9% annual return, your money would double in 8 years (72/9 = 8).

Kind of neat, huh?

Besides being a pretty nifty tool to keep in your back pocket, the Rule of 72 helps to illustrate that compound interest – over long enough periods – is the same as exponential growth.

All traditional investments can benefit from the power of accumulated compound interest. We will start by looking at fixed interest investments, then move to riskier investment options. The reality is that in a higher interest rate environment, you can get a decent return on fixed interest – you may not need to take on quite so much additional risk!

Ok, let’s dive in.

... but first, a word about debt!

Remember that Einstein quote from earlier?

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.”

Compound interest can work for you, but it can just as easily work against you. In the case of debt – particularly with credit cards and other high-interest consumer debt – compound interest can erode your family’s wealth faster than you can imagine!

🔎 Related: Active vs. passive vs. discretionary investment strategies

This means that if you’re carrying consumer debt, you need to pay it down as quickly as possible. No compound interest investment can combat the destruction of a 29.90% APR (which is not uncommon in today’s rate environment).

Money market and high-yield savings

After eliminating debt, your next stop should be a money market or high-yield savings account. This is the ideal place to park your emergency fund and short-term savings.

You can get a 3-4% rate of return (or more) while still maintaining the liquidity of a traditional savings account. Most money market and savings accounts allow a certain number of monthly withdrawals without penalty. Some even allow unlimited withdrawals as well as check writing capabilities. A quick online search should show what rates and features are currently available.

What's the difference between money market and high-yield savings?

A money market account is a short-term investment vehicle that attempts to maintain a share price of $1. The underlying investments are typically CDs, Treasury bills, and commercial paper.

Historically, these have been very safe investments, however they are not insured by the FDIC. This may be a concern for some investors. High-yield savings accounts are generally offered through online banks and pay rates much higher than you could find at your local bank. These accounts are insured by the FDIC, up to $250,000 per person, per account.

Certificates of deposit (CDs)

I bought my first CD in 2001: 4.8% for five years. I remember people telling me I was crazy to lock in such a low rate for such a long period…turns out it wasn’t such a bad move after all.

Now, over 20 years later, CDs are back in style! Researching right now, I can find several in the 5.5% range.

What is a certificate of deposit?

A CD is a short-term investment offering a fixed interest rate for a set period of time – usually stated in months. Typical investment periods are six months, 12 months, 18 months, and so on.

🔎 Related: 25 most powerful bible verses about finances (+ key insights)

CDs are good option if you have a specific short-term savings goal in mind. For example, maybe you’re planning to buy a house in three years, and you want to save towards the down-payment. A CD or CD ladder would be a great choice here as they give you both a reliable interest rate and maturity date.

Downside of CDs

If you have to redeem your CD before it matures, you will owe a penalty. Also, be aware that when your CD matures, you have a small window of time (usually 7 – 10 days) in which to withdraw or transfer your funds. If you fail to act during this grace period, your CD will automatically renew, almost certainly at a much lower interest rate.

Individual Treasury Bonds

Individual Treasury bonds are technically a simple-interest investment; a bond is sold at a discount and when it matures, the investor received the face amount. Some bonds also pay a semi-annual coupon.

Bonds are mentioned here because their yields are currently quite attractive (around 5 – 5.5%) and because many investors choose to create a rolling bond ladder which effectively turns their bonds into a compound interest investment.

What is a bond ladder?

A bond ladder contains multiple bonds with staggered maturities. The goal here is to diversify across maturity dates and minimize exposure to interest rate fluctuations. In a rolling bond ladder, as each bond matures, the face amount (as well as any coupon interest paid) is then reinvested into a new bond, allowing the earnings to compound over time.

This is a fairly hands-on strategy and won’t be for everyone, but if you’re interested, check out TreasuryDirect.gov or ask your brokerage house or financial advisor for assistance.

Fixed annuities

Some people hear the word “annuity” and want to run to the furthest ends of the earth. I can certainly understand why!. Many annuities are so complicated it seems you would need a PhD to understand how they work.

Some also come with high surrender fees and/or long surrender periods. For instance, you may end up “locked in” to a product longer than you would like. These are valid concerns; I’m not trying to diminish them.

I would be remiss, however, if I didn’t mention fixed annuities — also known as Multi-Year Guaranteed Annuities (MYGAs). This product operates almost exactly like a CD – you invest a single lump-sum premium for a fixed period of time, guaranteed at a fixed interest rate (currently around 5 – 5.5%).

🔎 Related: How to invest for retirement at age 40 (+ examples)

Just as with a CD, you are locked in for the investment period. Surrender penalties are high, so don’t invest in a MYGA unless you have enough other liquid funds to cover your needs.

Mutual Funds/ETFs

Mutual funds and Exchange Traded Funds (ETFs) are both baskets of securities, packaged together in a way in which they can easily be bought and sold on the open market.

Mutual funds have long been considered an ideal way to save for retirement, as they provide market exposure, diversification, and liquidity at a fairly low cost. ETFs are mutual funds’ younger cousins – providing similar market exposure and diversification, but with even greater liquidity at even lower cost.

Mutual funds and ETFs are considered riskier than the investments discussed above, but they are still great compound interest investment options for the long-term. Mutual funds and ETFs can be broken down into two basic types of funds: bond funds and equity funds.

Bond Funds hold – you guessed it – bonds

A bond is a loan the investor makes to the bond issuer. With bond funds, you typically purchase groups of bonds with similar characteristics – this could be U.S. Treasuries of various duration, international bonds, corporate bonds, high-yield bonds, municipal bonds, inflation-protected bonds, etc.

There could be anywhere from a few dozen to hundreds or thousands of bonds in a single bond fund. The underlying bonds pay interest (usually monthly), but because they are traded on the open market, the value of the fund can fluctuate greatly over time.

Equity Funds hold stocks

These are riskier than bonds, but are still considered to be safer than investing in individual stocks. Equity funds earn income from their underlying stocks that pay dividends (typically quarterly). Equity funds can also fluctuate greatly in value and over long time periods, they tend to outperform bonds.

🔎 Related: Investment Strategy, the Sound Financial Way

Many investors choose to hold some combination of stock and bond funds. A common mix is the 60/40 portfolio – 60% equity and 40% bonds. To make this a compound interest investment, you should elect to reinvest interest and dividends. Over long periods of time, this can be a very successful investment plan.

In the last 30 years, for example, a 60/40 portfolio earned about a 7.8% compound annual return. There is no guarantee, of course, that future returns will mirror the past.

Individual stocks

Individual stocks – particularly those that pay dividends – can work well to generate compound interest if you have a long time horizon and a high tolerance for risk.

A stock, or equity, is a security that represents ownership of a small portion of the issuing company. Some stocks pay dividends as a way to distribute corporate earnings to shareholders. If those dividends are used to purchase additional shares through a dividend reinvestment program (DRIP), you can earn significant compound interest over long periods of time.

Over the past 25 years, the S&P 500 has gained 10.2%. Keep in mind, however, that stock market prices can be volatile, and individual stocks don’t always go up – there’s always the risk of bankruptcy, corporate scandal, or other disaster.

REITs

A Real Estate Investment Trusts (REIT) is an entity that owns and operates income-producing real estate. These are unique in that they offer a way for individual investors to participate in real estate profits without having to buy or manage physical property themselves.

A REIT may own commercial property (retail locations, office buildings, and healthcare facilities), residential property (multi-family apartment buildings and mortgages), or some combination of both. REIT funds can be bought and sold through most major brokerage houses.

These funds typically pay a high dividend yield and have outperformed the S&P 500 over many investment periods.5 The downside? They are very volatile. Most advisors recommend only a very small portion of an investor’s portfolio be allocated to REITs.

Ready to earn compound interest through investments?

Great – we’d love to hear from you!

Here are a few critical questions to ask yourself prior to meeting with a financial professional — whether that's us or someone else:

- What are my family’s goals – short, medium, and long-term?

- How much money do I want to invest?

- What type of return am I expecting?

- What is my time horizon – will I need this money a few years from now, or can I stay invested for the long-term (possibly decades)?

- Do I want a guaranteed return, or am I willing to take on greater risk for the chance of a larger return?

- Do I have sufficient emergency funds to meet unexpected needs that may arise? If not, how quickly can I build this up?

By knowing the answers to these questions (or even taking the time to just think about what the answers may be), you will make it easier to choose the best compound interest investments for your family with the assistance of a professional.