7 min read

How Does the U.S. Economy Work? (An Accessible Overview for All)

Oct 18, 2023 1:53:29 PM

How Does the U.S. Economy Work? (An Accessible Overview for All)

Recently, a client asked me a great question: “Is there a book you can recommend that explains the economy (for dummies preferably)?”

I love this question because it shows a keen interest in learning and planning. First, this man is far from a dummy – he has advanced degrees in his field. Neither are you. We are all a professional at something, even if we do not completely understand economics.

Second, I have a stack of books that I recommend, including:

- Trend Following by Michael Covel

- The Psychology of Money by Morgan Housel

- Your Money after the Big 5-0 by Larry Burkett and Ron Blue

- The Millionaire Next Door by Thomas Stanley and William Danko

However, these books are primarily about financial planning and investments. We need to answer the question, “How does the economy work?” in an easy-to-understand manner.

There is a tremendous amount of scholarship out there that addresses this question in great detail — this video presentation by Ray Dalio is a personal favorite of mine. But today, my goal is to go beyond some of the more traditional academic (see: "jargon-filled") definitions you may have heard before — you know, the kinds that can sometimes create more questions than answers — with accessible knowledge of how our economy truly works.

Now, even if you're working with an investment professional who has spent years (even decades) living and breathing this stuff, I strongly encourage you to take a few minutes to read through this article.

Yes, it's important to be a well-informed citizen in today's sometimes tumultuous economic climate. More importantly, however, cultivating a baseline knowledge of the inner workings of the U.S. economy can help you be a more active and engaged participant in the process of planning for your financial future.

Now, let's dive in.

Imagine you are in a market place, an old-fashioned town square

You know, the kind you grew up in, or may have seen in the movies or read about in books. You may have once ridden your bike, worked a delivery route, or had your office on our town square.

Next, imagine the places and people on the square. There is the downtown bakery, the Lyric Theater, the lumber yard, the county bank, the courthouse, the church on the corner, the library down the street, and your favorite grocery store.

🔑 Free resource: Financial planning strategy template

Everyone in town is a player in this market place. There are builders, workers, investors, owners, politicians, and policemen. Everyone is in charge of something, and everyone answers to somebody. You have multiple important roles, also. You work, spend, raise a family, and live life as you move in and out of this market place.

When you go to the grocery store, you are a buyer of groceries. Each employee, investor, and owner of the grocery store is a seller of groceries. You purchase your groceries by giving the clerk (or the self-checkout computer) your money. The grocery store pays its employees, suppliers, lenders, and investors, then keeps the rest of your money as profit.

Each of these players then spends their money at the downtown bakery for a donut and coffee every morning. Or someone takes a date to the Lyric Theater on Friday night. Another person fixes their porch with lumber from the lumber yard, tithes to their church, or pays a late-fee to the library. The government, in the courthouse, taxes everyone to pay for the roads, the protection, and up-keep of our town square.

🔎 Related: Is the stock market gambling?

When you go to work at the downtown bakery (by the way, imagine you are a wonderful cook!), you are a seller of the bakery’s goods and services. You supply a warm, tasty treat, desserts, hot coffee, and a place to gather for the players on the town square.

You also do two other critical things:

- When you are paid, you not only buy groceries – you spend your money everywhere within our square.

- When you save your money, the bank can then lend that money to someone else at their own risk, while still protecting your money for you.

Do you get the picture?

Pay close attention – each part of the economy moves similarly, following common sense. The challenge is that there are millions of moving parts and millions of players called "people" — unfortunately, people who don’t always follow common sense. Despite the potential complexity, there are only two primary economic roles: buyers and sellers.

If you pay attention to these two roles, you can figure out the puzzle called economics.

The U.S. economy is one giant market place

It's the big town square, if you will. Each of us is both a buyer and a seller, depending on our activities. From Main Street to Wall Street, it basically works the same.

There is another name for these buyers and sellers – supply and demand. Generally, buyers = demand and sellers = supply. The supply and demand chart is most often used to explain economics.

Imagine you plan to open a pizza shop in our town square

Everybody thought your pizza at the downtown bakery was the best! You will be rich overnight. But first, you must run a good business to go with your excellent pizza cooking skills. You need to know:

- How much pizza supplies to purchase

- What prices you should charge

- How much you can pay your employees

- What profits are possible.

You're great at making delicious pizza, but now you are also an investor. You have to get this right. This is where you start to think about supply and demand for your new venture.

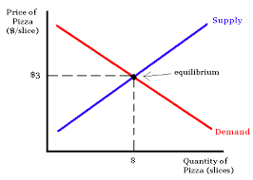

The red line moving from the upper left to lower right indicates the amount of demand for your pizza slices. The x-axis (the bottom horizontal line of the chart) equals the number of slices.

The blue line moving from the lower left to upper right indicates your supply of pizza slices, i.e., how many slices you are cooking and hoping to sell. The y-axis (the vertical line of the chart) indicates the price per slice of pizza.

Equilibrium is the point at which the supply and demand lines cross

In other words, this is the point where all of the buyers wanting your pizza are willing to pay your price. Equilibrium is the natural point for which the market place is searching. In this case, eight slices of pizza for $3 each.

You should notice that if the quantity or price of pizza slices is too high or low, supply and demand will not match. These will then shift so they do match or find equilibrium.

🔎 Related: How much does investment management cost?

For example, imagine on opening night you pack your restaurant with 50 customers who eat three slices of pizza each. However, you cooked 200 slices, over cooking by fifty slices. What will you do with the left-over fifty slices? (You will probably give them away to your employees and celebrate a great opening night. But that messes up our example.)

Pretend for a moment that you must sell those slices. Therefore, you will lower the price of those fifty slices to $1 each until someone will purchase your remaining pizza. In other words, supply and demand will always react to each other and meet at a price, even if that price is zero.

Throughout the U.S. economy, buyers and sellers meet to purchase each other’s goods and services — from pizza slices and wedding cakes, to skyscrapers and stocks and bonds. Buyers (demanders) and sellers (suppliers) will agree to a price and make a transaction (equilibrium).

The Federal Reserve, the fuel for the U.S. economy

A unique characteristic of the United States is our central bank, the Federal Reserve. They provide fuel to our economy in the form of dollars, as well as a monetary policy that is unique throughout history. Our rule of law allows this to happen.

For example, most of the transactions between buyers and sellers are governed in some way that protects the buyers’ rights and the sellers’ ownership, creating value for both. Similar laws instruct the Federal Reserve to promote maximum employment, stable prices, and moderate long-term interest rates.

The fuel of our town square is the U.S. dollar

It is the medium that we use to trade for goods and services. Think about it, you don’t trade your pizza slices for a haircut, do you?

The more fuel (dollars) flowing in our economy, the more money buyers have to spend, the higher prices move, and the entire supply/demand curve shifts up the chart. As the number of dollars increase in the economy, the faster the economy grows. The reverse is true also. When the Fed wants to slow the economy down (which they do to avoid overheating, i.e., inflation), they remove dollars from the economy, typically by raising interest rates.

🔎 Related: Active vs. passive vs. discretionary investment strategies

If this topic is starting to get confusing, refer back to the supply and demand chart. If all of your customers have more money, you can charge $10 per slice instead of $8. And they will gladly pay it because they want your pizza and they have the money.

Remember, economics follows common sense

Does it make sense to you that if all of your customers, your friends and co-players in the town square, have more money, they can easily afford to pay $10 per pizza slice? Economics starts to get complicated when there are thousands of unintended consequences.

For example, you may have to charge $11 per slice of pizza because your suppliers have increased their prices and your employees demanded a raise – all because more dollars have flooded into your Town Square. And don’t confuse an increase in price with an increase in value – they are not necessarily correlated.

For now, just focus on the supply/demand relationship and the knowledge that dollars are our economic fuel.

Markets and you, from Main Street to Wall Street ... and back to your home

Let’s move out of imaginary space and apply these concepts to you. You live, work, and play in multiple town squares. Your local economy, your state, our country, and even your workplace all move within these rules – each of them affecting you deeply. But the only economy you can control is the one in your household.

You have demanders within your home

Your family needs a roof over their heads, the bills paid, food on the table, cell phones, TVs, clothes, vacations, savings accounts, investments accounts…should I keep listing? No, you get the picture.

The list can get long, but you control what goes on the list. You can decide how much to spend on each item. And just like the larger economy, members of your family have tremendous influence. I know, I have three teenagers at home! But you must control the economy in your household if you want to succeed financially.

🔎 Related: 25 most powerful bible verses about finances (+ key insights)

Please don’t misunderstand me and become a dictator, nor should you misunderstand what you can and can’t control. For example, you do not control the price for many of the items your family buys, but you can control how much you spend on those items.

Therefore, you’ll want to budget and have a financial plan to determine the financial direction in which you want your family to go, as well as how you will get there.

You also have suppliers within your home

Everyone who earns and contributes their income within your home is a supplier. My wife and I are the suppliers within our home. My daughters earn an income through summer and after-school jobs, but they are not paying the bills. So, just like in our town square, where the players decided how much of your pizza to buy on opening night, my wife and I decide how much we will spend on the demands of our household.

We have financial goals that we want to meet. We want to be generous to those in need, invest for the future, while also enjoying life today. These goals have led to a financial plan that determines how much we will spend on each of the Demanders’ categories.

Through this process, we control the economy in our household:

- Financial goal-setting

- Financial planning based on those goals

- Taking action, periodic review, and self-discipline to follow our plans

Is it perfect? Of course, not. Does it guarantee success? Heavens, no! I could lose my job, the market could crash, or we could have a large unexpected medical expense. But we recognize that God has blessed us with resources and opportunities, and that by managing these well, we have a high probability of success.

I suspect the same is true for you. You probably have all that you need to succeed and the opportunities to create even more. So, I challenge you, start managing the economy in your household today.