1 min read

1 min read

Nov 19, 2024 6:33:27 AM

A ProShares article written in June 2024 highlighted a unique opportunity for investing in dividend stocks known as the Aristocrats. These are companies in the S&P 500 known for decades-long dividend growth. In November 2024, these stocks are trading at 72% of the S&P 500’s price-to-earnings ratio, a significant discount considering this relationship is typically reversed.

Historically, such low relative valuations often signal future outperformance, with Dividend Aristocrats providing steady returns. This rare valuation level may be a promising entry point for investors seeking stable income and growth.

But why invest in these “boring ole’ blue chippers” when the Magnificent Seven are on a tear?

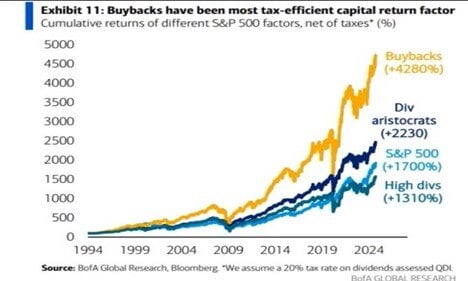

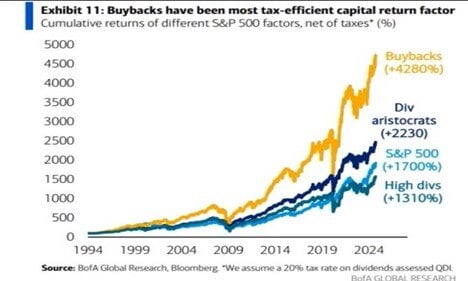

Consider this chart:

Over the last thirty years, dividend aristocrat stocks have outperformed the S&P 500 by a wide margin. These stocks are typically a bit more stable. So, why do investors seem to struggle to stay invested in them?

Let's face it: Sherwin-Williams, Stanley Black & Decker, and AFLAC are not nearly as cool as Apple, Amazon, and Nvidia. Even if Nick Sabin and Coach Prime are in your commercials.

But again, consider: What does Clorox make? I bet your answer is bleach. But in the investing world, the answer is money. Clorox produces steady revenue and has consistently increased its dividend since 1978, indicating a classic, well-run company.

Warren Buffett made a fortune buying “wonderful companies at fair prices.” So, we believe that twenty-five years of stable and increasing dividends indicates a “wonderful,” but how do we determine a fair price?

We let the market answer that question for us.

At Sound, we determine our universe of stocks similar to the dividend aristocrats, developing a list of stocks with at least twenty-five years of stable and increasing dividends, i.e., “wonderful companies.” Next, we rank our stocks by the fast-growing price over the last twelve months, investing in the top fifty names, i.e., “fair prices.”

Certainly, our strategy is a little different than the value strategy that Warren Buffett made famous. However, the philosophy is sound and we believe the results will speak for themselves.

If you want to learn more about Sound Financial's dividend growth strategy, let’s schedule some time to talk. We would happily discuss your financial goals and determine if our planning and investing system can help you reach them.