Business Valuation Guide

WHAT IS YOUR BUSINESS WORTH? HOW CAN YOU INCREASE ITS VALUE? FIND OUT NOW.

Take The Guide With You

You’ve Worked Hard to Build Your Business

Now, you’re at an exciting point in the lifecycle of your company when you’re likely asking yourself two critical and very smart questions:

- “What’s my business really worth?”

- “How can I make it more valuable?”

Now, the reasons you’re asking these questions may vary. Perhaps you’re:

- Thinking about selling your business soon and wanting to retire comfortably.

- Planning to sell one day and want to start the process of making it more attractive to buyers.

- Considering borrowing against your business and need to know its value before you approach the bank.

- Developing a succession plan, whether it’s passing the business down to your children or selling to a partner.

I’ve seen too many folks get to this point and feel overwhelmed, not knowing where to start or who to trust. I get it—it’s not easy to dig into the nitty-gritty of what makes your business tick. But that’s what we’re here for. This guide is about helping you understand the true drivers of value in your business, showing you how to turn the right knobs to make sure you’re getting the most out of what you’ve built.

Whether you’re thinking about selling, passing it down, or just tightening things up, we’ve got your back. We’re in this together, and I’m here to help you get a clear picture of where you stand with your business and where you can go from here.

Chris McAlpin | Chief Experience Officer

Joel Holden | President/Chief Operating Officer

Table of Contents

-

Unpacking Your Messy Financial Garage in Your Business

-

What Are the 5 Pillars of Business Valuation?

-

Common Pitfalls in Business Valuation

-

Legal Considerations for Business Valuation

-

Operational Considerations for Business Valuation

-

Organizational Considerations for Business Valuation

-

My Journey from Wall Street to My Purpose

This Business Valuation Guide Isn’t a Quick Fix

If you’re just looking to slap a number on your business and call it a day, this guide isn’t for you. You won’t find a quick fix here to bolster your business valuation or a simple equation that gives you all the answers. But if you’re here because you want to dig deeper and truly understand what makes your business valuable, then you’re in the right place.

This business valuation guide is about getting everything in order so you can clearly see what you’re working with and, more importantly, how to make it better. It’s not just about knowing what your business is worth today; it’s about figuring out what drives that value and how you can increase it moving forward.

We’ve done this before—we’ve helped folks just like you take their businesses to the next level by getting their financial house in order. And trust me, I’m not just talking theory here; I’ve lived it. So if you’re ready to roll up your sleeves and get serious about what really drives the value of your business, keep reading.

We’re going to show you how to turn those knobs and make your business more valuable, whether you’re looking to sell, pass it down, or simply improve what you’ve already built.

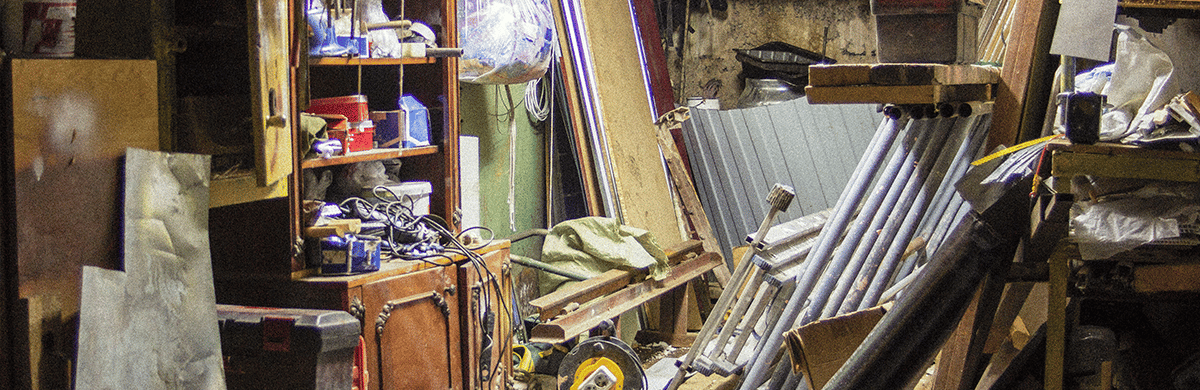

Unpacking Your Messy Financial Garage in Your Business

Let’s take a moment to address something that might not be front and center but is crucial—the messy financial garage that every business has, including yours. Now, I’m not here to point fingers or make you feel bad, but the truth is, every business has one. And that’s nothing to feel ashamed about.

I know from experience that when you’re busy running your business, working hard to make it successful, it’s not always easy to remember to dot every “i” or cross every “t.” So, over the years, it’s understandable that certain things might have slipped through the cracks.

Maybe it’s those old customer contracts that haven’t been looked at in a while, or perhaps the way your expenses are tracked isn’t as tight as it could be. Maybe your financial records are scattered across a few different systems, and you’re not entirely sure what’s where. Again, it happens to the best of us.

As a part of this process, you’ll need to sort through that messy financial garage—those neglected records, disorganized processes, and overlooked assets that are holding you back. If you don’t take the time to get in there and really organize what you’ve got, you could be leaving significant value on the table.

Think of it like trying to sell your house without fixing up the place. Sure, you could find a buyer, but they’re not going to pay what it’s really worth if the roof’s leaking or the paint’s peeling. The same goes for your business—if your financials, contracts, and processes are all over the place, you’re not going to get top dollar when it comes time to sell, borrow, or plan for the future.

But here’s the good news: this guide isn’t just about telling you to clean up the mess. We’re going to walk through it together. I’m going to show you how to sort through that garage—what needs to be organized, what’s safe to toss out, and what you should shine a spotlight on. We’ll look at your financial records, contracts, and processes to ensure everything is in tip-top shape. This isn’t just about getting organized for the sake of it; it’s about making sure you’re maximizing the value of your business.

And remember, this isn’t something you have to tackle alone. We’ve done this before, and we’re here to help. Whether it’s pulling out the financials that haven’t been reviewed in years or tightening up your operational processes, we’ll get your business in the best possible shape so that when the time comes, you’ll know you’re getting every penny it’s worth.

What Are the 5 Pillars of Business Valuation?

When you’re thinking about increasing the value of your business, you can’t just focus on one thing. It’s not enough to have your financials in order if the rest of your business isn’t working as well as it could. A valuable business is built on multiple pillars that hold everything up.

We’re talking about legal, financial, operational, organizational, and philosophical foundations. Each one of these plays a crucial role in how much your business is worth—today and tomorrow:

1. Financial

Now, let’s get into the numbers. Understanding the financial health of your business goes way beyond knowing how much revenue you bring in. You need to know your cash flow, understand your profit margins, and be crystal clear on your financial projections. If you’ve been treating your financials like that messy garage we talked about earlier, it’s time to clean it up. We’re going to explore how to get a true picture of your financial standing and how to make the necessary adjustments to increase your business’s value.

2. Legal

First things first, if your legal structure isn’t solid, you’re building on shaky ground. This isn’t just about having your paperwork in order—it’s about making sure your business is protected and that you have the right agreements in place. If your operating agreements are outdated, if you’re not clear on succession plans, or if your contracts leave too much to interpretation, you’re leaving value on the table. We’ll dive into how to shore up these legal aspects so you can move forward with confidence.

3. Operational

A business that runs efficiently is a business that’s worth more—plain and simple. This pillar is all about the systems and processes that keep your business humming along. From how you manage your supply chain to the way you handle customer service, every piece of your operation impacts your bottom line. We’re going to look at how to streamline these processes, cut out the inefficiencies, and make sure your business is running like a well-oiled machine.

4. Organizational

Let’s not forget about your team. Your people are one of your greatest assets, and the way you structure your organization can significantly impact your business’s value. If your business depends too heavily on you or a few key individuals, it’s vulnerable. We’ll discuss how to build a strong leadership team, delegate effectively, and create a resilient organization that can thrive without being dependent on any single person.

5. Philosophical

This might be the most overlooked pillar, but it’s just as important as the others. The philosophical foundation of your business—your mission, vision, and values—drives your company’s culture and long-term goals. A business with a clear purpose and strong values is more than just a money-making machine; it’s a legacy. We’ll explore how to articulate and embed these values into your business to create a lasting impact.

The Role of Emotion in Business Valuation

When you’re deeply invested in your business, it’s easy to let your emotions cloud your judgment. You might overvalue your business because of the time and effort you’ve put into it, or you might be afraid to look at the real numbers because you don’t want to face reality.

The truth is, emotions can significantly impact your ability to make sound business decisions. It’s essential to separate your personal feelings from the actual value of your business. This guide will help you navigate those emotions and focus on what really matters: the facts.

Why These Topics Matter to Your Business Value

They’re the bedrock of a business that’s truly valuable. We’ll dig into each one in detail, breaking down what they mean, why they’re important, and how you can strengthen them. The goal here is to give you a comprehensive view, so you know exactly where to focus your efforts to get the most out of what you’ve built.

You’ve got to approach your business from all these angles. Think of it as tightening the bolts on a machine. If one bolt is loose, the whole thing doesn’t run as smoothly, and you could end up losing out on the value you’ve worked so hard to build. Addressing each of these areas means you’re not just patching things up; you’re reinforcing the structure of your business, making it stronger and more resilient.

Common Pitfalls in Business Valuation

Now, before we dig into those different pillars, we need to make sure you’re going into this process not only with the right mindset, but also with greater visibility into what we’ve found are the most common pitfalls and blindspots even the most savvy business owners can fall prey to.

These aren’t just minor oversights—they’re mistakes that can cost you real money if you’re not careful. Let’s talk through the key ones you need to watch out for.

Relying Too Much on a Single Valuation Method

One of the biggest traps business owners fall into is thinking there’s a magic formula that will give them the perfect number. Maybe you’ve heard about discounted cash flow or some earnings multiple and think that’s all you need.

But the truth is, no single method will give you the full picture of what your business is worth. It’s like trying to judge a book by its cover—you’re only seeing a small piece of the story. Bottom line, you’ve got to look at your business from multiple perspectives to really understand its value.

Overlooking the Details in Your Financials

It’s easy to get caught up in the big picture and ignore the details, especially when you’re busy running the day-to-day operations. But if you’re not on top of your financials, you’re setting yourself up for trouble.

Your financial records are the foundation of your business’s value, and if they’re not in order, you’re not going to get an accurate valuation. It’s like trying to drive a car without checking the oil—it might run for a while, but eventually, it’s going to break down.

Poor Timing

Timing is everything when it comes to valuing your business. Market conditions, the state of your industry, even the seasonality of your business can all affect your valuation. If you try to get a valuation at the wrong time, you might end up with a number that doesn’t reflect the true worth of your business.

It’s like selling a house in the middle of a downturn—you’re not going to get the price you want. That’s why it’s so important to be strategic about when you go through this process.

Not Bringing in Professional Help

I’ve seen too many business owners try to go it alone when it comes to valuing their business, and more often than not, it doesn’t end well. Valuing a business is a complex process that requires a deep understanding of both the financials and the market. It’s not something you can just figure out on your own.

Bringing in a financial advisor or a business broker who knows what they’re doing can make all the difference. They can help you avoid costly mistakes and make sure you’re getting an accurate valuation.

Addressing the Fear of the Unknown

Now, there’s something else we need to talk about—fear. I’ve had plenty of conversations with business owners who are afraid to get their business valued because they’re worried about what they might find. Maybe you’re thinking your business isn’t worth as much as you’d hoped, or maybe you’re afraid that digging into the numbers will reveal some problems you didn’t know were there. That fear is real, and it can stop you from taking action.

But here’s the thing—by avoiding the valuation process, you’re actually putting yourself at a disadvantage. You’re letting that fear hold you back from making the most of what you’ve built. This guide is designed to help you face that fear head-on. We’re going to walk through the process step by step, so you know exactly what to expect. And by the time we’re done, you’ll have a clear picture of your business’s value and a plan to make it even stronger.

Financial Considerations for Business Valuation

I’ve spent years sitting across the table from entrepreneurs just like you—folks who’ve poured their heart and soul into building something that matters. It’s not just a business; it’s your livelihood, your dream, and maybe even your legacy. But no matter how passionate you are, when it comes to the financial side of things, it can get overwhelming.

Whether you’re thinking about selling, bringing in a partner, or just figuring out how to fund the next stage of growth, those numbers can start to feel like a mountain you’re not sure how to climb. However, getting a handle on your business’s financial health isn’t just important—it’s essential.

You might be running on instinct, making gut decisions that have worked out so far, but without a solid understanding of your financials, you’re flying blind. The truth is, the numbers tell a story, and if you want to maximize the value of your business, you need to make sure it’s a story that ends well.

Together, we’re going to walk through five critical financial steps we’ll walk through:

-

Understanding your financial baseline: Get a clear, accurate picture of your current financial position to make informed decisions.

-

Analyzing what’s working and what’s not: Identify which parts of your business are profitable and which are holding you back.

-

Investing in technology and people: Make strategic investments in technology and personnel to drive efficiency and growth.

-

Planning for the future: Develop a long-term strategy, including succession planning and expansion, to prepare for what’s ahead.

-

Building accountability and a support team: Establish accountability and surround yourself with the right advisors to keep your business on track.

In this section, I'm going to walk you through these five steps that every entrepreneur should be thinking about. These aren’t just theoretical ideas; they’re actionable strategies that I’ve seen work time and again. By the end of this, you'll have a clearer picture of what you need to do to drive up the value of your business.

1. Understanding Your Financial Baseline

The first thing we need to talk about is getting a clear understanding of your financial baseline. I know it might sound basic, but you’d be surprised at how many business owners out there are making decisions based on outdated or downright inaccurate financial data. I can’t tell you how often I’ve seen folks trying to run their business on numbers that are 60, 90, even 120 days old, thinking they’ve got a handle on things. Let me tell you, if your financials aren’t current and accurate, you’re flying blind.

When I sit down with a business owner, the very first thing I want to see is their financials—balance sheet, income statement, cash flow, all of it. But here’s where a lot of folks get it wrong: if your balance sheet isn’t accurate, then nothing else is either. Your balance sheet is the cornerstone of your financials. If there are mistakes there, those mistakes will flow through everything else.

You’ve got to know where you stand before you can figure out where you’re going. That means having up-to-date, accurate financials—no exceptions. This isn’t the sexy part of running a business, but it’s critical. Without this foundation, you’re making decisions in the dark, and that’s a dangerous place to be as a business owner. Get your financial house in order, because without it, you’re just guessing, and guessing isn’t how you drive value.

2. Analyzing What’s Working and What’s Not

Once you’ve got your financials in order, it’s time to dive into the data and really analyze what’s working and what’s not. Here’s the thing: every business has its strengths and weaknesses, and your numbers will tell you exactly where those are. I’ve seen too many business owners trying to do everything—offering every service they can think of, taking on projects that don’t align with their core strengths, and wearing themselves thin in the process.

The reality is, not all revenue is good revenue. If you’re spending too much time and resources on services that aren’t profitable, you’re actually hurting your business. This is where you need to start making some tough calls. Look at your financials and identify which products or services are driving profitability and which ones are dragging you down. Once you’ve got that clarity, it’s time to start trimming the fat. Focus on what you do best, and do more of it. It’s not about doing more; it’s about doing the right things more effectively.

3. Investing in Technology and People

We live in a world where technology is advancing at lightning speed, and if your business isn’t keeping up, you’re going to fall behind. That’s why investing in your technology and your people matters. But I’m not just talking about getting the latest gadgets or software for the sake of it. I’m talking about making smart, strategic investments that will actually improve your efficiency and help you grow.

For instance, if you’re still managing your books with outdated software—or worse, manually—it’s time for an upgrade. The right technology can save you time, reduce errors, and give you better insights into your business. But it’s not just about the tech; you’ve also got to invest in the right people. As your business grows, you simply can’t do it all yourself. You need to bring in people who can take over tasks that aren’t your area of expertise or that are taking up too much of your time.

This might mean hiring an admin to handle the day-to-day, bringing in a financial advisor to help with strategic planning, or outsourcing specific functions to specialists. The bottom line is, you need to build a team and infrastructure that can support your business as it scales.

4. Planning for the Future

Let’s talk about planning for the future. Too many business owners get so caught up in the daily grind that they forget to think about where they want to be in five, ten, or twenty years. But here’s the deal—if you don’t have a plan for the future, you’re not preparing your business for what’s to come, and that’s a recipe for trouble.

Whether it’s succession planning, exit strategies, or growth, these are things you need to be thinking about now, not later. If you’re planning to sell your business, you should’ve started preparing three years ago. The due diligence process alone can take six to twelve months, and that’s before you even start talking about the transition. If you’re not thinking about these things now, you’re going to get caught off guard when the time comes.

And if you’re planning to expand, you’ve got to be strategic. Whether it’s taking on new partners, securing financing, or investing in new equipment, every decision matters. With interest rates rising, these choices are more critical than ever. You’ve got to plan ahead, think strategically, and be ready for whatever comes your way.

5. Building Accountability and a Support Team

Finally, let’s talk about accountability, because every entrepreneur needs it. Running a business is tough, and it’s easy to lose focus when you don’t have someone holding you accountable. That’s why it’s so important to have an accountability partner—whether it’s a mentor, a coach, or a peer—someone who will push you to achieve your goals and call you out when you’re slipping.

I always suggest setting up regular check-ins with your accountability partner, whether it’s weekly, monthly, or quarterly. These meetings are where you review your goals, assess your progress, and make the necessary adjustments. It’s also a time to brainstorm, bounce ideas off someone you trust, and get the support you need to keep moving forward.

But accountability isn’t just about having someone to answer to. It’s also about building a support team around you—your CPA, financial advisor, attorney, and anyone else who plays a key role in your business. These people should be in the loop on your decisions, helping you make informed choices and keeping you on track. It’s about building a network that supports your success.

This Is the Story of Your Business

Your financial statements need to tell the true story of your business. Take a good, hard look at your trailing 12-month income statement and balance sheet. Do they really reflect the business you’re running today? Are there cash balances that aren’t accounted for, or credit card debts that somehow slipped through the cracks? These things can sneak up on you.

Why does this matter? When someone comes in to evaluate your business—whether it’s an investor, a lender, or a potential buyer—they’re going to base their judgment on those numbers. If your financials don’t match up with the reality of your business, you’re going to have a tough time convincing anyone of its true worth.

It’s not enough to just know in your gut that your business is valuable; you’ve got to show it in the numbers. Those financial statements need to be telling the same story you are. So, get your financials in line. Make sure they’re accurate, up-to-date, and truly reflective of where your business stands today. Because if you want others to see the value you see, you’ve got to back it up with solid, reliable numbers.

Legal Considerations for Business Valuation

When it comes to assessing and increasing the value of your business, one area that often gets overlooked is the legal structure and documentation that supports everything you've built. If your legal structure isn’t solid, you’re building on shaky ground. Legal issues can disrupt your business, reduce its value, and even jeopardize a sale or succession plan.

Whether it's outdated operating agreements, unclear succession plans, or poorly drafted contracts, these legal shortcomings can leave significant value on the table. By addressing these areas now, you’re not only protecting what you’ve built, but you’re also making your business more attractive to potential buyers, investors, or successors.

Together, we’ll review four key legal aspects that every business owner needs to consider as they go through the valuation process—although, honestly, these are legal areas you should have buttoned up regardless as to whether or not you’re focusing on the value of your company:

- Operating agreements: Ensuring your business’s operating agreements are up-to-date and reflect the current state of the business.

- Succession planning: Creating a clear, legally binding plan for the future of your business, whether it’s passing it down to family or selling to a partner.

- Contracts: Reviewing and tightening up contracts to avoid ambiguities and protect your business interests.

- Compliance and regulatory issues: Making sure your business complies with all relevant laws and regulations to avoid penalties and maintain operational integrity.

A Quick + Important Disclaimer

Now, before we dive in, it’s important to clarify that what you’re about to read is not legal advice. Every business is unique, and legal requirements can vary widely depending on your industry, location, and specific circumstances.

To ensure that your business is legally secure, consult with qualified legal professionals who can provide tailored advice and help you implement the strategies that are right for your situation. The insights shared here are meant to guide your thinking and highlight key areas that often need attention, but they’re no substitute for professional legal counsel.

1. Operating Agreements

Operating agreements are the documents that define how your business is run—e.g., who has control, or what happens in various scenarios, such as the departure of a partner or the dissolution of the company. If your operating agreements are outdated or poorly constructed, you’re setting yourself up for potential conflicts down the road.

Over the years, your business may have evolved—new partners may have come on board, roles may have shifted, or the business might have pivoted in a new direction. If your operating agreement doesn’t reflect these changes, it can lead to disputes that not only disrupt your operations but also negatively impact your business’s value.

Examples of common operating agreement documents include:

- Operating Agreements for Different Business Formations

These agreements outline the management structure, roles, and operational procedures for various types of business entities—e.g., LLC, corporations, etc. - Partnership Agreement

A contract between partners in a business, detailing the terms of the partnership, including profit-sharing, decision-making, and dispute resolution. - Shareholder Agreement

An agreement among a company’s shareholders that outlines the rights and obligations of the shareholders, including the management of shares and the operation of the company. - Buy-Sell Agreement

A document that establishes how a partner's share of the business may be reassigned if that partner dies or otherwise leaves the business. - Joint Venture Agreement

A contract between two or more parties who agree to combine resources for a specific project or business activity while sharing the profits, losses, and control. - Corporate Bylaws

A set of rules established by a corporation's board of directors that governs how the company will operate and be governed.

Take the time to review your operating agreements regularly. Make sure they accurately reflect the current state of the business, the roles and responsibilities of all partners, and how major decisions will be made.

If there are gaps or ambiguities, it’s crucial to address them now, before they become bigger issues. An up-to-date and comprehensive operating agreement provides clarity and stability, both of which are key to maintaining and increasing your business’s value.

2. Succession Planning

Succession planning is another critical legal aspect that often gets overlooked until it’s too late. Whether you plan to pass your business down to the next generation, sell it to a partner, or bring in new leadership, having a clear, legally binding succession plan is essential.

Without a solid succession plan, you’re leaving the future of your business to chance. This not only creates uncertainty for your employees and stakeholders but can also significantly reduce the value of your business. Potential buyers or investors want to see that there’s a clear path forward, no matter what happens to the current leadership.

Again, this is where a qualified professional can be a tremendous asset as a guide through this process. However, some questions you will want to consider as you develop this plan may include:

- What are my ultimate goals for the business after I step away?

- Who is the best person or team to lead the business into the future?

- What will the transition process look like, and how long will it take?

- How will the succession plan impact key stakeholders, including employees, customers, and partners?

- What are the financial implications of the succession plan?

- Do I have the necessary legal documents in place to support the succession plan?

- How will the plan be communicated to all relevant parties?

- How will I ensure the ongoing success and stability of the business after I step down?

- Is the plan flexible enough to adapt to unforeseen circumstances?

Your succession plan should outline who will take over the business, how the transition will be managed, and what will happen in the event of unforeseen circumstances, such as the sudden departure of a key leader. It’s also important to ensure that your succession plan is legally binding and that all stakeholders are on board with it. This will give you peace of mind knowing that your business will continue to thrive, even if you’re not at the helm.

3. Contracts

Contracts are the backbone of any business relationship, and if they’re not airtight, you could be exposing your business to unnecessary risks. Whether it’s contracts with customers, suppliers, partners, or employees, having well-drafted agreements is crucial to protecting your business interests.

Over time, it’s easy to let contracts slide—maybe you’re still operating under an old agreement, or perhaps you’ve been using the same boilerplate contract for years without revisiting it. But as your business grows and evolves, your contracts need to evolve too.

Take the time to review all your contracts and identify any areas where you might be exposed, in consultation with professional legal counsel. Questions you may want to consider as you review your contracts include (but are not limited to):

- Are the terms clear and unambiguous?

The language should be straightforward to prevent misinterpretations and reduce the potential for disputes. - Are the payment terms and conditions clearly defined?

Payment structures, due dates, and penalties should be clear to avoid misunderstandings and cash flow issues. - Do the contracts adequately protect your business in the event of a dispute?

Check for clauses specifying how disputes will be handled, such as arbitration or litigation, to safeguard your business. - Are there any outdated provisions that no longer apply?

Review for any clauses that are no longer relevant to your current business circumstances. - Is there a clear termination clause?

The contract should outline the conditions for termination, including notice periods and any associated penalties. - Are the responsibilities and obligations of each party clearly defined?

Each party’s roles should be clearly stated, leaving no room for confusion about duties and expectations. - Have all legal and regulatory requirements been addressed?

The contract must comply with current regulations to avoid potential legal risks. - Do the contracts include a confidentiality or non-disclosure clause?

There should be provisions to protect sensitive business information from unauthorized disclosure. - Are the intellectual property rights clearly defined (if applicable)?

Ownership and usage rights of intellectual property should be outlined to prevent future disputes. - Is there a force majeure clause?

The contract should address unforeseen events that could prevent either party from fulfilling their obligations. - Are the governing law and jurisdiction clearly stated?

The contract should specify which state or country’s laws govern the agreement and where disputes will be resolved.

Tightening up your contracts can prevent legal headaches down the road and ensure that your business is protected, which in turn enhances its value.

4. Compliance + Regulatory Issues

Last but certainly not least, we need to talk about compliance and regulatory issues. Every industry has its own set of laws and regulations that businesses must adhere to, and failure to comply can result in hefty fines, legal action, and a tarnished reputation—all of which can severely impact your business’s value.

It’s important to stay on top of any regulatory changes that affect your industry and ensure that your business is in full compliance with all applicable laws. This includes everything from employment laws and tax regulations to environmental and safety standards. Regular compliance audits can help you identify potential issues before they become serious problems.

Additionally, if you operate in multiple jurisdictions, make sure you’re aware of the laws in each area and that your business is compliant across the board. Non-compliance in one location can affect your entire business, so it’s crucial to address these issues proactively. By maintaining compliance, you not only protect your business from legal risks but also make it more attractive to buyers and investors who want to know they’re acquiring a legally sound enterprise.

Build a Solid Legal Foundation for Your Business

When it comes to increasing the value of your business, having a solid legal foundation is just as important as having your financials in order or your operations running smoothly. By ensuring that your operating agreements are up-to-date, your succession plan is clear and legally binding, your contracts are airtight, and your business is fully compliant with all relevant laws and regulations, you’re laying the groundwork for a business that’s not only protected but also primed for growth and increased value.

Remember, legal issues may not be the most exciting part of running a business, but they’re absolutely essential to its long-term success. Don’t leave this part of your business to chance. Take the time to shore up these legal aspects now so you can move forward with confidence, knowing that your business is on solid ground.

Operational Considerations for Business Valuation

By Joel Holden

This section is for entrepreneurs who want to get serious about tightening up their operations to drive business value. Now, to be fair, if you’re a business owner who’s grown your company through grit and hustle, chances are you’ve got a lot of things running pretty well, even if it’s not perfectly polished.

But when it comes to increasing the value of your business, it’s not enough for things to run smoothly on the surface. The real value-driver of your enterprise lies in having efficient, scalable operations that don’t rely on you as the bottleneck.

With that in mind, we’re going to walk through several key operational considerations that will help you not just maintain the business but scale it, reduce risks, and boost overall value. By the end of this section, you’ll know exactly what needs to happen to turn your operations into a machine that can run without you, including:

- Documenting processes to create consistency and scalability.

- Regularly auditing and updating those processes.

- Standardizing operations to ensure scalability.

- Identifying and eliminating inefficiencies that are quietly draining value.

- Optimizing your customer-facing processes to improve experience and value.

Much of this doesn’t sound terribly sexy, I know. But if you’re serious about increasing the value of your business in a meaningful and sustainable way, pay attention.

Every Task You Do More Than Once Needs a Process

I don’t care if it’s a “small” task, like how you onboard a client, or big, like managing your supply chain—everything needs to be documented. Why? Because when things break down (and trust me, they will) you’ll have no idea where the breakdown happened, why it happened, or how to get everything back on track without a documented process you can point to as a single source of truth.

Imagine you own a manufacturing plant. One day you find out that a crucial part of your inventory is missing, and everyone is pointing fingers about who’s at fault.

What happens next? Without a process, you’ll spend hours, maybe days, figuring out why that part wasn’t ordered, where the breakdown occurred, and how to prevent it from happening in future. Did Mary forget to do it? Was it Billy’s job? Who knows?

Now your production line is at a standstill, and you’re losing money by the hour. All of that could’ve been avoided if you had a simple process in place.

Operational Bottom Line

Document everything. If you do something more than once, it needs to be written down—no exceptions. This creates accountability, ensures consistency, and gives you something to point to when things go wrong.

Once You’ve Got Processes, Review + Update Them

Here’s where most businesses fail: they create a process and then forget about it. The process you put in place last year might not work for your business today, especially as things change and grow. Processes need to be reviewed and updated on a regular basis.

Take something simple, like your hiring process. Let’s say you update your employee benefits package, but your onboarding documents haven’t been updated in two years. Now you’ve got new employees who are getting the wrong information. Suddenly, something as basic as benefits becomes a problem that you didn’t see coming, all because you didn’t review the process.

Operational Bottom Line

Review your processes regularly. If it’s something you do monthly or quarterly, make it a point to review the process at least once a year. If it’s something you do daily, like invoicing or sales, you should be checking it every few months.

Standardization Is How You’ll Grow

If you want your business to grow, you need to get out of the day-to-day and stop being the “hands on” bottleneck. Because if your business relies on you to be in the weeds across your operation, growth will never be an option, as you are not a scalable resource. That means standardizing your operations. I’m talking about making sure every department has a clear process that doesn’t rely on one person’s memory or skills.

Take your sales process, for example. If you’re the only one who knows how to write a proposal or close a deal, then your business will never grow beyond you. Standardize the process so anyone on your sales team can follow it and get the same results. This doesn’t just make your business scalable; it makes it more valuable because now someone else can step in and keep things running smoothly.

Operational Bottom Line

Standardize everything. Whether it’s customer service, production, or sales, every function in your business should have a clear, repeatable process. This ensures your business can grow without being dependent on you or a few key people.

Inefficiencies Are Quietly Draining Your Value

Most business owners are focused on growth, and that’s fine. But if your operations are inefficient, it doesn’t matter how much your business is growing. Inefficiencies will cost you money, and eventually, they’ll catch up with you.

For example, let’s say your inventory system is outdated and you’re constantly running out of stock. Right now, it might not seem like a big deal because you’re adding new customers. But as your business grows, those small inefficiencies start to compound, and before you know it, they’re eating into your margins.

Operational Bottom Line

Find and eliminate inefficiencies. Regularly audit your operations to identify where things are slowing down, costing more than they should, or leading to errors. Fix them now, before they turn into bigger problems down the line.

Operations Impact Customer Experience—Big Time

Don’t forget that the way your business operates directly affects your customers. If your operations are disorganized, that chaos will trickle down to the people who buy from you. Late deliveries, inconsistent quality, or poor communication—it all adds up, and your customers will notice. And when your customers aren’t happy, it’s not just your sales that take a hit; your business’s value takes a hit, too.

Think about it this way: when a customer has a problem, how easy is it for them to reach you? And once they do, how quickly can you resolve their issue? If your operations are streamlined, this is easy. If not, you’ll start losing customers, and that’s something any buyer or investor will notice when they evaluate your business.

Operational Bottom Line

Align your operations with customer expectations. Make sure you have systems in place that allow you to respond quickly to customer issues, deliver products or services on time, and maintain consistency across the board.

Don’t Wait Until Disaster Strikes

The most valuable businesses are the ones that run smoothly behind the scenes. By documenting processes, reviewing them regularly, and eliminating inefficiencies, you’re not just protecting your business—you’re increasing its value and ensuring it can grow without you being involved in every single decision.

To get started, ask yourself these questions:

- Are all the critical tasks that get repeated in my business clearly documented?

- How often do I review the processes I’ve put in place?

- Do I have standardized procedures that anyone on my team can follow?

- Where are the inefficiencies hiding in my operations, and what are they costing me?

- How does my operational efficiency impact the customer experience?

If you’re unclear on the answers to any of those, then it’s time to take action. Don’t wait until disaster strikes before you tighten things up. The businesses that thrive are the ones that are proactive. By putting the right operational structures in place now, you’re setting yourself up for growth, sustainability, and ultimately a higher valuation down the road.

Organizational Considerations for Business Valuation

By Joel Holden

Your business is only as strong as the people behind it. When I talk to business owners about improving the value of their business, I always tell them that the organizational structure is one of the most critical—and often overlooked—aspects.

You could have the best product or service in the world, but if you don’t have the right team, you’re not going to grow the way you should. And when it comes to increasing the value of your business, you can’t overlook how important a strong organizational structure is.

If you want to build a strong, resilient organization that doesn’t rely on you for day-to-day operations, I’ve got you. I’m going to help you step back, evaluate your organizational structure, and build something that can thrive without your constant oversight.

By the end of this section, you’ll understand the fundamentals of:

- How to build a leadership team that can operate without you.

- Why clear accountability and delegation are essential.

- The importance of putting the right people in the right seats.

- How to structure your business so it can scale without depending on you.

- Why your team and structure have a direct impact on your business’s value.

Build a Leadership Team That Can Operate Without You

Yes, your business needs you. But how much it needs you is something you need to examine carefully. Yes, as the owner of the business, you drive the “big picture” vision for the future, as you should.

But if your business can’t function without you making every decision, then you’ve got a problem. If you’re constantly being dragged into the day-to-day operations of your business, to the point where you aren’t able to take a step back consistently to develop your growth strategy, you’ve got a problem.

That’s why building a solid leadership team is about hiring people who can take ownership of key parts of your business. You shouldn’t be the one running every department or solving every problem. Your job is to build leaders who can take responsibility for their areas, make decisions, and get things done without running everything by you.

When you have a strong leadership team in place, it frees you up to focus on the bigger picture—whether that’s growing the business, planning for the future, or even taking time away without worrying that things will fall apart. This shift allows you to work on the business, not just in it, and that’s where real growth happens.

Organizational Bottom Line

Build a leadership team that can take ownership in a way that makes you feel confident to step away when you need to. Hire leaders who are capable of managing their departments without your constant oversight, allowing you to focus on the bigger picture. And if you don’t have leaders you can trust in that capacity, you know what you need to do.

Accountability and Delegation Are Essential

Delegation isn’t about handing off tasks just to get them off your plate. It’s about making sure the right people are accountable for the right things. Every person in your business should know exactly what they’re responsible for and what success looks like in their role.

If your team doesn’t have clear accountability, you’re going to waste a lot of time fixing mistakes, answering questions that should’ve already been addressed, and ultimately, you’ll find yourself micromanaging everything. And trust me, that’s no way to run a business.

When everything flows through you, that’s not scalable. Delegation frees you up. However, it only works when you delegate with clear expectations and measurable outcomes. Everyone should know what they’re accountable for, how their success is being measured, and what happens if they don’t meet those expectations.

So, take the time to sit down with your key people and define what success looks like in their roles:

- Is everyone clear on what’s expected of them?

- Are your people hitting targets?

- Are deadlines being met?

- Are team members making decisions with confidence, or do they constantly need reassurance?

Clear expectations remove guesswork. Without them, your team might feel they’re doing a good job, but you’ll be frustrated because they’re not meeting your standards.

Accountability is all about ownership. Your team needs to take full ownership of their responsibilities and the results they’re accountable to. When something goes wrong, they need to be the ones coming to you with solutions, not problems. That’s real delegation. It’s not just about trusting your team; it’s about empowering them to take control of their areas.

Organizational Bottom Line

Establish clear accountability structures. Make sure every team member knows what they’re responsible for and how their performance will be evaluated. This keeps everyone on the same page and prevents miscommunication.

Put the Right People in the Right Seats

It’s not enough to have good people—you need to have the right people in the right roles. I see a lot of businesses where talented people are being wasted because they’re not in the right position. I’ve also seen cases where leaders see talent or “potential” in an individual, but they simply aren’t a fit for the role or the organization.

You’ve got to be willing to make tough decisions. If someone isn’t a fit for the role they’re in, it’s better for both them and the business if you make a change. At the same time, don’t forget to reward your top performers. People need to know they’re valued, and when they do, they’ll stick around. And when your best people stick around, that’s when your business really starts to thrive.

Team dynamics will change as your business grows. The needs of your business today aren’t the same as they were when you started, and they won’t be the same a year from now. This means you need to regularly evaluate where your people are and how they’re contributing.

Sometimes it’s about putting a great employee in a different seat where they can have a bigger impact. And if someone’s role has outgrown them, it’s time to make a change—whether that means finding a new position within the company or letting them go.

Now, why does this matter to the value of your business?

When it comes time for an investor or potential buyer to evaluate your company, they’ll look at your team. They want to know that you’ve built a sustainable, scalable business, and having the right people in the right positions shows that your business can keep running smoothly, even without you in the driver’s seat.

Organizational Bottom Line

Evaluate your team regularly. Make sure the people you have are in the roles where they can make the biggest impact. And don’t hesitate to make changes if something isn’t working. At the same time, don’t forget to reward and recognize your top performers.

Structure Your Business for Scalability

If you want to scale your business, your organizational structure needs to be built for growth. That means your business shouldn’t rely on one or two key people—especially not you. Yes, we’re talking about you as a bottleneck again.

If you’re the only one who knows how to keep the business running, you’ve got a serious risk on your hands. A strong organizational structure distributes responsibilities across your leadership team, allowing the business to function whether you’re there or not.

The truth is, if you’ve built your business the right way, you should be able to step away for a few months, and everything should run just fine without you. If that’s not the case, it’s time to rethink your organizational structure.

Organizational Bottom Line

Build a scalable organizational structure. Delegate responsibilities and make sure your business can operate smoothly without being dependent on you or a few key individuals.

Organizational Health Impacts Valuation

When potential buyers or investors look at your business, one of the first things they’ll evaluate is your organizational structure. They want to know if your business can run without you and if the team in place is capable of continuing to grow the company. If your business is too reliant on a few key people, that’s going to be seen as a risk.

A healthy organization—where responsibilities are clearly defined, and the leadership team can operate independently—adds value to your business. It shows potential buyers that the business is sustainable and can continue to grow after you’re gone.

To get started, ask yourself these questions:

- Do I have a leadership team capable of making decisions without my involvement?

- Do all team members know what they’re responsible for and how their performance is measured?

- Are the right people in the right roles, or do I need to make changes?

- Could my business run smoothly without me for a few months?

- Does my team structure allow the business to scale, or am I the bottleneck?

Don’t wait until you’re burned out to start building a resilient organization. The businesses that grow and succeed long-term are the ones that invest in their people and structure today. By putting the right organizational systems in place, you’re not just protecting your business—you’re setting it up for long-term growth and a higher valuation.

My Journey from Wall Street to My Purpose

By Aaron Dillon

Today, I’m the Managing Director of Pacer ETFs, overseeing billions in assets, but the path to get here has been anything but typical. My career started in New York, working in consulting before I moved on to Morgan Stanley. I was part of the team during the financial crisis that helped navigate some of the biggest mergers in the industry, including the acquisition of Smith Barney.

After the dust settled, I found myself at TD Ameritrade, running the mutual fund and ETF business, and on track to become a managing director by the time I was 31. But life has a way of shaking things up. The turning point for me came when my wife almost died giving birth to our first child. She had a life-threatening condition called HELLP syndrome, and watching her go through that was a wake-up call. It made me rethink everything—what I was doing, why I was doing it, and what really mattered to me.

I Needed a Change

That’s when I decided to walk away from my corporate career and take a leap into entrepreneurship. A friend, John Crane, called me up with an idea to start an ETF company focused on China. At first, I was hesitant—it seemed like a hard no. But after what happened with my wife, I felt compelled to do something different, something with purpose.

We started with nothing but a couple of laptops and a lot of hope. There were years when we didn’t take a paycheck, and we were down to our last two thousand dollars at one point. But we kept going, and today, that company is the largest China-focused asset manager in the U.S., with $10 billion in assets under management.

The Questions That Matter Most

Along the way, I’ve had some big wins, like when we sold Galileo to SoFi for $1.2 billion. But even with all the success, I found myself questioning what it was all for. Making money was great, but it wasn’t enough. I started asking myself:

- What’s the point of all this?

- What am I really working towards?

That’s what brings me to the philosophical side of business valuation. It’s not just about the numbers—it’s about understanding your purpose. Because at the end of the day, your business is a vehicle for something bigger. If you don’t know what that bigger thing is, you might find yourself feeling empty, even when the money starts rolling in.

Finding Your “Why”

The first thing I always tell people is to find their “why.” Why are you doing this? Why are you in business? For a long time, I thought my “why” was about making money, climbing the corporate ladder, and hitting those big milestones. But after my wife’s close call, I realized that wasn’t it at all. Making money is important—don’t get me wrong. But it’s not the endgame. Your “why” has to be about something more.

For me, my “why” has evolved into helping others achieve financial independence and security. When we launched Pacer ETFs, it wasn’t just about creating financial products; it was about empowering people to take control of their financial futures. That’s a purpose that gets me out of bed in the morning. It’s what drives me to push through the tough times and keep going, even when things get hard.

But your “why” doesn’t have to be the same as mine. It’s personal. It could be about providing for your family, making a difference in your community, or building something that outlasts you. The key is to figure out what it is that really matters to you—what you want your legacy to be.

The Philosophical Angles Within Your Own Business

Legacy and Long-Term Thinking

Speaking of legacy, that’s another big part of the philosophical side of business. I think a lot of us, especially when we’re younger, get caught up in the short-term wins. We’re focused on hitting the next revenue target, closing the next deal, or getting that next promotion. But as you get older, you start thinking more about the long-term—what kind of impact you want to leave behind.

For me, legacy isn’t just about being remembered. It’s about creating something that continues to have value long after I’m gone. It’s about building a business that doesn’t just make money, but that also stands for something. When I think about Pacer ETFs, I want it to be known as a company that made a real difference in people’s lives, that helped them achieve their financial goals, and that operated with integrity and purpose.

That’s why I’m so focused on the long-term strategy. It’s easy to get caught up in the day-to-day grind and lose sight of the bigger picture. But I always try to keep that legacy in mind. What are we building here? What will it look like 10, 20, or even 50 years from now? Will it still matter?

The Human Element

Another thing that’s become really important to me is the human element of business. We talk a lot about assets, revenues, and profits, but at the end of the day, business is about people. It’s about the relationships you build, the lives you touch, and the impact you have on those around you.

I’ve seen too many business leaders forget this. They get so focused on the numbers that they lose sight of the fact that their employees, customers, and partners are real people with real lives. When I think about the businesses I admire, they’re the ones that treat people with respect, that value their employees, and that make a positive impact on their communities.

At Pacer ETFs, we try to live this out by fostering a culture that’s supportive, collaborative, and focused on helping each other succeed. We’re not just here to make money; we’re here to make a difference in the lives of the people we work with and the people we serve.

The Role of Faith in Business

Values and beliefs play a significant role in how we approach business, and for me, my faith has been a central guide. Now, I realize that not everyone shares the same faith or spiritual outlook, but we all have core beliefs and values that shape our decisions and interactions. Whether it’s a religious faith, a strong ethical code, or a personal philosophy, these guiding principles are what keep us grounded, especially when faced with tough choices.

For me, my faith informs how I lead, how I treat people, and how I define success. It’s about living out values like honesty, integrity, and compassion every day—making sure that I’m not just chasing profits, but also doing the right thing. That’s what keeps me focused on what really matters, and it helps me navigate the challenges that come with running a business.

But even if faith isn’t a big part of your life, the key takeaway here is the importance of having a set of guiding principles. Whether they come from your upbringing, your personal experiences, or your own reflections on life, these values are what will help you make decisions that align with your true self. They’re what keep you centered and help you build a business that you can be proud of, no matter what the world throws at you.

Success Redefined

As I’ve gone through this journey, my definition of success has changed. Early on, I thought success was all about climbing the ladder, making more money, and hitting those big goals. But now, I see it differently.

Success, for me, is about balance. It’s about having a successful business, yes, but it’s also about having a happy family, good health, and a sense of purpose. It’s about making a difference in the world and leaving a positive legacy. It’s about knowing that when I look back on my life, I’ll be proud of what I’ve done—not just in terms of the numbers, but in terms of the lives I’ve touched and the impact I’ve made.

And that’s something I think more business leaders need to think about. It’s easy to get caught up in the chase for more—more money, more power, more success. But at the end of the day, what’s it all for? What are you really working towards? For me, it’s about finding that balance and making sure that I’m not just successful in business, but in life as a whole.

The Importance of Ethical Leadership

One of the things I’ve learned is that ethical leadership is crucial in today’s business world. It’s not just about doing the right thing because it’s the right thing to do—although that’s important. It’s also about building trust and credibility with your stakeholders. People want to do business with leaders they trust, with companies that stand for something more than just profit.

I’ve seen what happens when leaders don’t lead ethically. It might work in the short term, but eventually, it catches up with you. The truth always comes out, and when it does, it can destroy everything you’ve built.

That’s why I’ve always tried to lead with integrity, to make decisions that I can stand behind, and to build a company culture that reflects those values. At Pacer ETFs, we’ve made a commitment to ethical leadership. It’s about being transparent, treating people fairly, and making decisions that align with our values. And it’s something that I believe is not just good for business, but good for the world.

Personal Growth and Continuous Learning

Another thing I’ve come to value is the importance of personal growth and continuous learning. The world is always changing, and if you’re not learning and growing, you’re falling behind. This is true in business, but it’s also true in life.

I’ve made it a point to keep learning, to keep challenging myself, and to keep pushing the boundaries of what I know and what I can do. Whether it’s learning a new skill, taking on a new challenge, or just reading a good book, I believe that continuous learning is key to staying relevant and successful in today’s world.

And it’s something I encourage in my team as well. We’re always looking for ways to learn and grow, to improve ourselves and our business. It’s part of our culture at Pacer ETFs, and it’s something that I believe sets us apart.

Build Your Business with Purpose

At the end of the day, business is about more than just making money. It’s about building something that has value, something that makes a difference in the world. It’s about finding your purpose, living out your values, and leaving a legacy that you can be proud of.

For me, that’s what the philosophical side of business valuation is all about. It’s about understanding what really matters and making sure that your business reflects those values. It’s about leading with integrity, treating people with respect, and building a company that stands for something more than just profit.

So, as you think about the value of your business, I encourage you to think about these things. What’s your “why”? What’s your legacy? How are you treating the people around you? And are you building a business that reflects your values?

Because at the end of the day, that’s what really matters. The numbers are important, but they’re not the whole story. The real value of your business is in its purpose, its impact, and its legacy. And that’s something that money can’t buy.

Get advisors you can trust, not a sales team trying to sell you a product.

We believe loving your neighbor as yourself also applies to how you do business.

A Plan to Achieve Freedom & Fulfillment

There is no one size fits all solution. First, we listen. Then we'll advise you on the best path forward based on what's important to you.

An Active Approach to Investing

We actively manage your money with our rules-based approach. You deserve better than the buy-and-hold industry status quo.

Fee

Transparency

Never wonder where commissions are being scraped off your earnings. As a fee-based firm, we show you exactly what you're paying for.